Many car dealerships had to temporarily close in order to comply with the Enhanced Community Quarantine implement by the government on March 16, 2020.

This raised a lot of questions from people regarding utility bills and payments, which also include vehicle owners who have existing car loans. Luckily, Suzuki Philippines got its customers covered.

Suzuki Philippines continues to make a good mark on the market – starting off with the launch of all-new Suzuki 2020 XL7 and S-Presso. Now, Suzuki released a payment deadline extension so its customers can receive service quality during these tough times with the COVID-19 pandemic.

2020 Suzuki XL7 Philippines: Specs, Features, and Pricing Overview

>>> Related: Latest COVID-19 news and updates

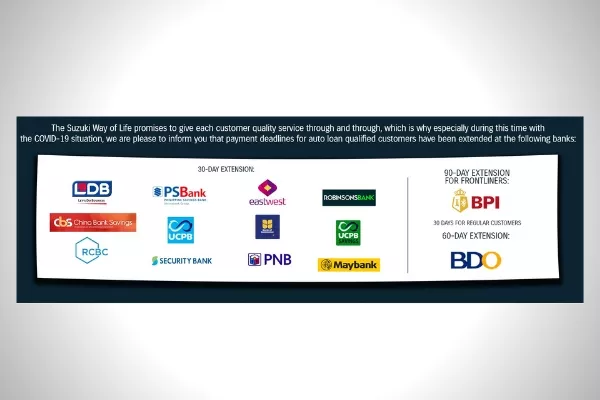

The following banks have extended their payment deadlines for auto loan qualified customers:

- PSBank (30-day extension)

- EastWest (30-day extension)

- Robinsons Bank (30-day extension)

- UCPB (30-day extension)

- UCPB Savings (30-day extension)

- China Bank Savings (30-day extension)

- Security Bank (30-day extension)

- Bank of Commerce (30-day extension)

- Maybank (30-day extension)

- RCBC (30-day extension)

- PNB (30-day extension)

- LDB (30-day extension)

- BDO (60-day extension)

- BPI (30-day extension for regular customers and 90-day extension for Frontliners)

>>> Related: Toyota Financial Services Philippines gives 30-day extension to customers

The new Suzuki S-Presso starts at Php 518,000

>>> Related: Mazda, SsangYong Philippines applies 30-day window for free PMS schedule

People still questioned Suzuki Philippines if the payment deadline extension would either delay or double the pay next due date. This is a big question especially for those who weren’t able to receive financial assistance from the company they are working for.

Maybank and PSBank clarified that their customer’s loan term or loan maturity date will be moved further by one month – then there are banks who only provided grace periods and dismissed late fees or penalties which means loaners still have to pay double the next due date.

Despite having to pay double the next due date, some people are still thankful that they have time to make a way in order to compensate for their doubled payment.

The official statement from Suzuki regarding COVID

If you have any further questions, you can call your respective bank for better clarification.

Here at Philkotse.com, we value your interest in new cars and the latest news in the auto industry. You can visit our website to find out more.