The day you’ve been waiting for has finally arrived, and now your new car is ready to be brought home from the dealership. You do the usual physical checks around and inside the unit, making sure that there are no unnecessary marks or scratches that will mar your new ride.

Not all new cars purchased have the original OR/CR included

You also take note of the freebies you’ve been promised when you were negotiating with your sales agent, whether it’s the floor mats, tools, or window tint. But part of the important deliverables along with your new car are the related documentation. There’s the user manual to help you figure out how to use its various features, the warranty and service booklet to keep track of your car’s maintenance and help with warranty claims, and the insurance policy that guarantees your car’s protection against untoward incidents.

However, your latest acquisition can only be driven on the road if you have the official receipt and certificate of registration, otherwise known as the OR/CR, valid for the first three years. Together, these serve as proof that your car is duly registered with the Land Transportation Office (LTO). You might notice that what the dealership gives you are photocopies of the OR/CR instead of the original, which can be a little confusing since you’ve already taken delivery of the vehicle.

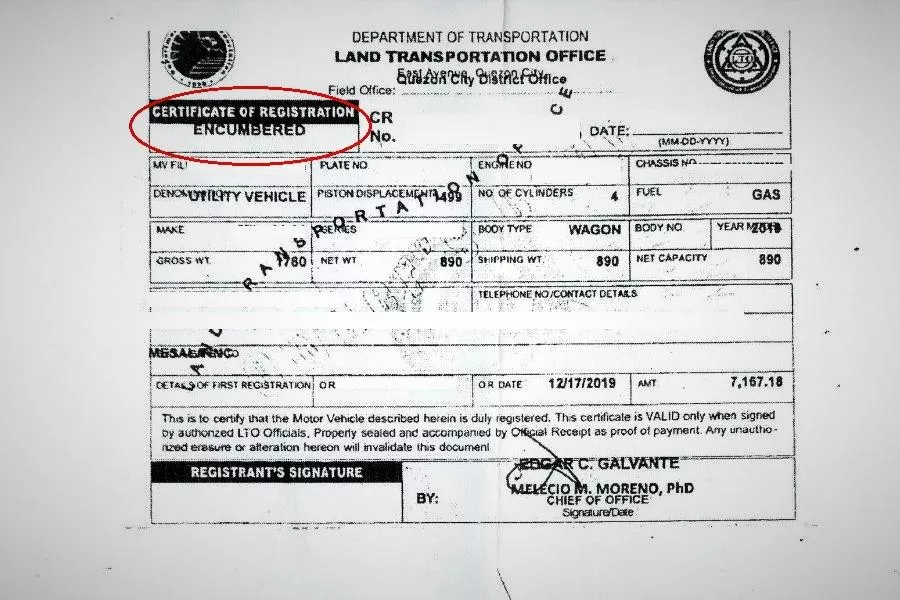

Vehicles that are under financing will have an 'Encumbered' annotation on their registration certificate

If you paid for your vehicle in cash, the original OR/CR should be handed over to you in a matter of days or weeks. But if your car was bought under financing, only the photocopy of the documents will be provided. This is because the original is under possession of the bank or lending institution that made the car loan possible. Technically speaking, the bank legally owns the vehicle until the loan is paid in full (try skipping out on payments for a month or two and you’ll see what we mean).

Cars under financing are mortgaged, and will typically have the ‘Encumbered’ annotation on the OR/CR. Once you’ve fully paid for the vehicle in accordance with the loan contract you signed, the bank will release the original CR to you. You’ll then need to have the encumbrance removed by the Registry of Deeds where the loan was listed, then go to the LTO branch where the vehicle was initially registered so you can be issued a clean CR without the annotation.

Find more tips for beginner car owners at Philkotse.com.

Recent posts

- LTO tips car registration Aug 23, 2021

- 7 essential documents needed when purchasing a car in the Philippines Jul 12, 2021

- are long auto loans ideal Apr 27, 2021

- What you need to know about car loans in the Philippines Aug 09, 2022