1. What is LTO MVUC Meaning?

If you have been driving for years, you would know that almost every transaction in vehicle registration at the Land Transportation Office (LTO) comes with a corresponding fee. This fee is actually called the Motor Vehicle User’s Charge (MVUC).

There are more fees to pay in LTO than you probably know

MVUCs vary depending on different vehicular factors such as vehicle type, gross vehicle weight (GVW), year model, and more. It is important that you know every detail your car has in order to prepare the appropriate amount in your next motor registration.

In the country’s laws, the MVUC is under the Republic Act No. 8794. This act is enacted to provide adequate maintenance of national and provincial roads through sufficient funding.

Changing your car paint comes with a fee

Although it is unlikely to pay the wrong amount these days, knowing the corresponding fee still pays. With all that being said, here are the fees and rates you would likely encounter in LTO vehicle registration transactions.

2. LTO MVUC fees & penalties

| PRIVATE AND GOVERNMENT VEHICLES | GVW | MVUC |

| Light passenger cars | Up to 1,600 kg | Php 1,600 |

| Medium passenger cars | 1,601 kg to 2,300 kg | Php 3,600 |

| Heavy passenger cars | 2,301 kg and above | Php 8,000 |

| Utility vehicles | Up to 2,700 kg | Php 2,000 |

| Utility vehicles | 2,701 kg to 4,500 kg | Php 2,000 + 0.40 x GVW in excess of 2,700 kg |

| SUVs (1991 models and above) | Up to 2,700 kg | Php 2,300 |

| SUVs (1991 models and above) | 2,701 kg to 4,500 kg | Php 2,300 + 0.46 x GVW in excess of 2,700 kg |

| Motorcycles without sidecar | N/A | Php 240 |

| Motorcycles with sidecar | N/A | Php 300 |

| Trucks and truck buses | 4,501 kg and above | Php 1,800 + 0.24 x GVW in excess of 2,700 kg |

| Trailers | 4,501 kg and above | 0.24 x GVW |

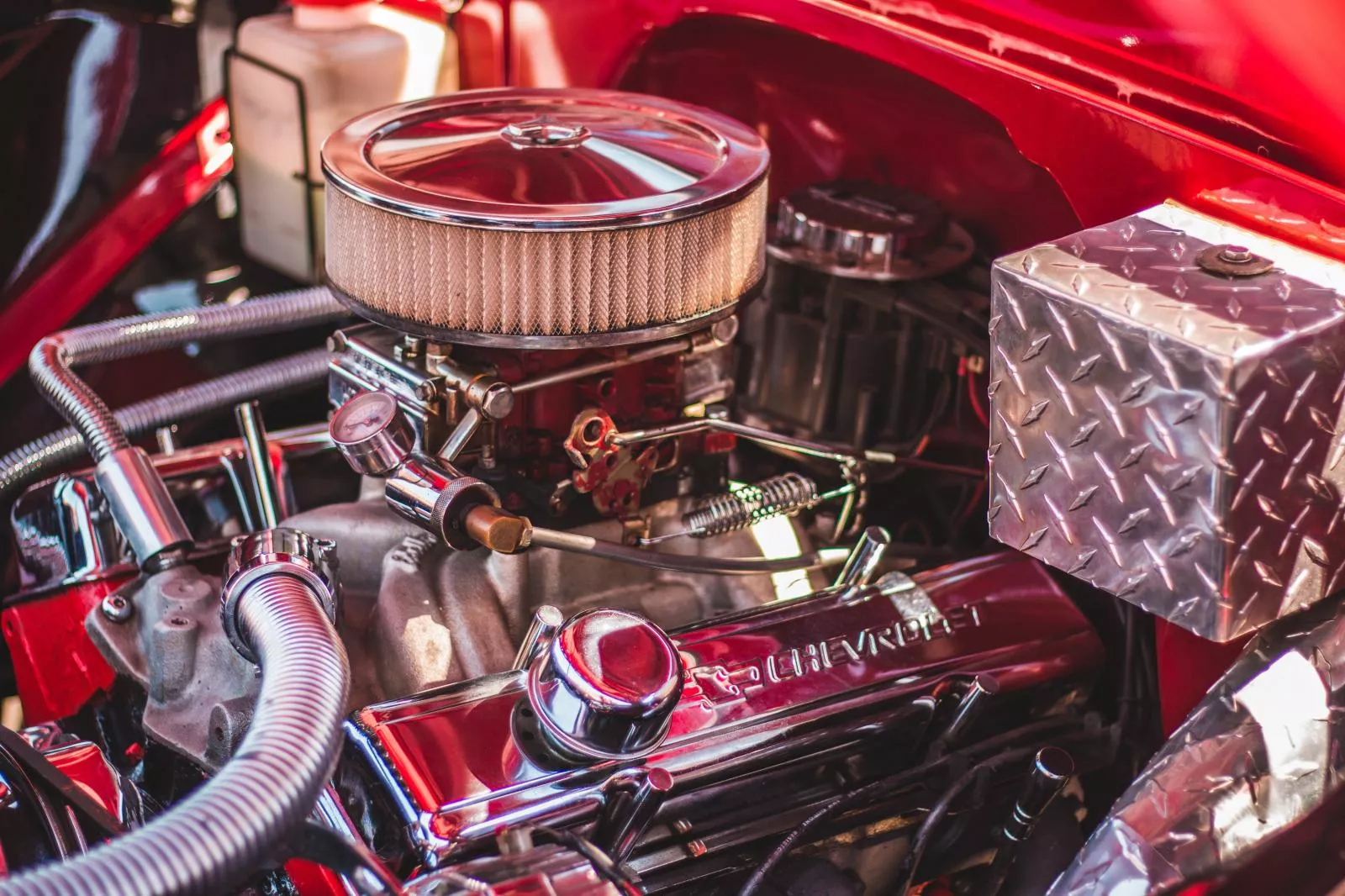

Even changing the engine of your car comes with a fee

| AGED PRIVATE VEHICLES | GVW | MVUC |

| Light cars (models from 1995 to 2000) | Maximum of 1,600 kg | Php 2,000 |

| Light cars (models from 1994 and older) | Maximum of 1,600 kg | Php 1,400 |

| Medium cars (models from 1997 to 2000) | 1,601 kg to 2,300 kg | Php 6,000 |

| Medium cars (models from 1995 and 1996) | 1,601 kg to 2,300 kg | Php 4,800 |

| Medium cars (models from 1994 and older) | 1,601 kg to 2,300 kg | Php 2,400 |

| Heavy cars (model from 1994 and older) | 2,301 kg and above | Php 12,000 |

| Heavy cars (models from 1994 and older) | 2,301 kg and above | Php 5,600 |

LTO’s context when it comes to aged private vehicles:

- Current – 2000

- One year old – 1999

- Two years old – 1998

- Three years old – 1997

- Four years old – 1996

- Five years old – 1995

- Over five years old – 1994 and older

| FOR HIRE VEHICLES | GVW | MVUC |

| Light passenger cars | Up to 1,600 kg | Php 900 |

| Medium passenger cars | 1,601 kg to 2,300 kg | Php 1,800 |

| Heavy passenger cars | 2,301 kg and above | Php 5,000 |

| Utility vehicles | Up to 4,500 kg | 0.30 x GVW |

| Sport Utility Vehicles (SUVs) | Up to 2,700 kg | Php 2,300 |

| Sport Utility Vehicles (SUVs) | 2,701 kg to 4,500 kg | Php 2,300 + 0.46 x GVW in excess of 2,700 kg |

| Motorcycles/Tricycles | N/A | Php 300 |

| Truck buses | 4,501 kg and above | 0.30 x GVW |

| Trailers | 4,501 kg and above | 0.24 x GVW |

You can schedule an appointment online for a faster transaction

| PENALTIES, CHARGES, AND OTHER FEES RELATED TO MVUC | |

| For vehicles beyond the registration week | Php 200 |

| Beyond the registration month but not more than 12 months | 50% of the MVUC rate |

| More than 12 months but without apprehension for violation of the Land Transport laws, rules, and regulation during the period of delinquency | 50% of the MVUC rate + renewal |

| More than 12 months but with apprehension for violation of Land Transport laws, rules, and regulations during the period of delinquency (Circular No. 83C-DIR-20) | 50% of the MVUC rate + renewal for every year of delinquency |

| Overloading provided that no axle shall exceed 13,500 kg | 25% of the MVUC at time of infringement for trucks and trailers with a load exceeding more than 5% of registered GVW |

| FEES AND CHARGES | RATES | FEES AND CHARGES | RATES |

| Accreditation fee for manufacturers, assemblers, importers, rebuilders dealers | - Php 500 (Application Fee) - Php 3,000/classification (accreditation fee) - Php 1,000/classification (renewal fee) - 100% of renewal fee/classification/year (penalty for late renewal) | Storage fee | Php 45 |

| Administrative fine for the accreditation fees above | - Php 100,000 (1st offense) - Php 500,000 and a suspension of not more than six months (2’nd offense) - Cancellation of Certificate of Accreditation (3rd offense) | Transfer of MV ownership | Php 50/transfer |

| Accreditation fee for other entities | - Php 1,000 (Certificate Fee for both individual and no dolla importation) - Php 100 (Tax exempt) | Top load fee | - Php 150 (buses) - Php 100 (cars and utility vehicle) |

| Certification of Data on MV stock report | Php 30 | MVIC emission test fee | - Php 40 (MC/TC) - Php 90 (UV) - Php 115 (trucks/buses) |

| Special Permit fee | Php 20/day (not to exceed 7 days) | MVIC inspection fee | - Php 50 (MC/TC) - Php 50 (UV) - Php 75 (trucks/buses) |

| Certificate of Tax Payment per Motor Vehicle | Php 30 | District Office inspection fee for the use of another District Office | Php 30 |

| Annotation of Mortgage, Attachment and other Encumbrances or Cancellation | Php 100 | New/initial registration regular motor vehicle plate | Php 450 |

| Change classification | Php 30 | New/initial registration MC/TC plate | Php 120 (per piece) |

| Change chassis | Php 30 | New/initial registration trailer plate | Php 225 |

| Change color | Php 30 | Validation and plate year tags | Php 50 |

| Change denomination | Php 30 | Replacement of validation stickers | Php 200 |

| Change engine | Php 30 | Duplicate and replacement of plates | - Php 450 (MV plate) - Php 120 (MC/TC plate) - Php 225 (trailer plate) - Php 450 (regular replacement plate) |

| Change of tire size | Php 30 | Vanity plates | - For auction (limited edition) - Php 15,000 (premium edition) - Php 10,000 (select edition) |

| Change of venue of MV registration | Php 100 | Special plates | - Php 25,000 (GMA-01; AAA-07; ARL-77) - Php 15,000 (DPJ-100; JPG-100; MMN-100) - Php 15,000 (MCM-707; DML-168; MTS-808) |

| Confirmation/Certification/ Verification/Clearance Fee | Php 30 | | |

| Deed of assignment fee | Php 100 | ||

| Duplicate/replacement of OR/CR | Php 30 | ||

| Penalty for late transfer | Php 150/transfer | ||

| Change body design | Php 100 | ||

| Carrying capacity | Php 100 | ||

| Reactivation fee | Php 30 | ||

| Recording fee | Php 500 | ||

| Revision of gross weight vehicle | Php 30 | ||

| Revision of record | Php 30 | ||

Be sure to settle all required MVUCs for a more convenient driving experience

>>> Related: LTO RFID sticker: What is it & how to install it properly?

3. FAQs about LTO MVUCs meaning

Q: What is MVUC in car registration?

MVUC stands for Motor Vehicle User’s Charge. It comprises of the charges and fees by LTO in dealing with motor vehicles.

Q: How much is the fine for late registration?

LTO imposes a Php 200 weekly fine for late registration. After a month of delayed payment, the fine shall become 50% of the MVUC.

Q: Can I change my motor vehicle plate?

No, you are not allowed to change your plate number. Your vehicle’s number plate shall be permanently assigned during its lifetime.

Q: How much is the fee for changing the color of my car?

If you decide to change the color of your car, you would have to pay Php 30 prior to registration.

Q: Can I give vanity plates as a gift?

Yes, as long as the recipient of the gifted vanity plate is a registered owner of a motor vehicle.

Here at Philkotse.com, we value your interest in the automotive industry. Visit our website to find out more.