There is one famous Filipino movie line delivered by actress Angelica Panganiban, “Ang pera natin, hindi nauubos. Pero ang pasensya ko, konting konti nalang!”. What joy, to have an endless supply of money. Unfortunately, that is not the case for the majority of the Filipinos – in real life.

We pay a lot of never-ending bills every month (electric, water, internet, load for calling and texting, tuition fees) there are so many expenses especially if you have children, but our money? They are very limited.

When buying a car, it is important to acknowledge your financial capacity to pay for the terms you have chosen

Some of us are thriving though and can save up to a sum which can already buy a brand-new auto and are on the decision-making process of actually purchasing one. If you have reached that point, first of all, congratulations! Next is I’d like to ask if you are 100% sure you are going to spend it in cash or buy your dream car in installment?

Did I make you think there? This article from Philkotse.com is not about tackling the reason why you want to buy a car for sale in the Philippines. We really don’t care if you’re buying it for necessity, business, or a status symbol. We’re here to help you decide with your payment options.

As early as this point, let me answer that question bugging your mind. If you have the money to buy the car, and you have enough for your savings and emergency fund too, then go ahead and pay it in CASH. Read on to know more about this topic.

>>> Find deeper insight into secondhand cars installment in the Philippines

I. Reasons to Buy A Car With Cash Payment

1. You want to avoid high interest rate

You might be thinking that you’re doing yourself a favor by paying car amortizations in installment because it won’t be “too heavy” for you. These are all just small chunks of money out of your pocket and you have a whole lot of the rest of your money to be spent on more important things – wrong!

For example, the scenario is you have the cash to buy the car but chose not too because you’re too afraid of letting that big amount of money go. We’re talking about a 1.5M Peso car. So you chose to pay in installment. After 5 years you were finally able to complete the payment that amounted to a grand total of 3M.

That’s double the price! To think you could have already bought yourself a second car had you only paid it in cash.

2. Installment leads to lost discount

A lot of car dealers are giving a hefty discount to buyers if they choose to pay upfront. Let’s go back to that scenario, buying the 1.5M peso car. The dealer told you if you pay upfront, you’ll get a 5% discount. Now, 5% might be a small number but that’s 75,000 pesos still that we’re talking about.

You know how the saying goes, “Wala ka ng madadampot na piso sa kung saan.” What more if we’re talking 75,000 pesos? That could go a long way (literally) you can travel out of the country with that kind of money.

While paying in cash may seem too much of a burden, you'll actually get more discounts by doing so

>>> Which is better: Diesel or Gasoline car?

3. Cars depreciate in value very quickly

We’re going to be speaking of economics here. Car depreciation is a result of the age and mileage of your car so it is inevitable. There are steps to counter it such as keeping it in good shape but let’s go back to that scenario we have: You buy that 1.5M peso car and finally completed its 5-year installment at 3M pesos.

When its value eventually went down, was the stress in monthly payment worth it after 5 years?

After 5 years though, your car is a wreck, it’s not the fashionable car anymore and if you plan on selling it? It will cost only about 1/3 of its original price which is around 500,000 pesos. If you plan on owning the car for another 5 years then depreciation will not be an issue for you, I must say.

But think about that, the car would be considered old and not safe already. The maintenance cost would have increased as well.

4. You no longer have to worry about monthly payments

I think this is the best reason on the list. If you have the money, why withhold it? That just means you also have a great job that pays well. If you pay a car upfront then you can start earning money again. And if in case you lose your job for a period of time then you won’t have any problems selling the car!

Monthly payment can be quite stressful especially if some unexpected expenditures happen

II. When You Should Pay a Car in Installment

1. You don’t have enough savings for paying in full and you really need the car

The main disadvantage of paying cash upfront for a car is that you will have to release a huge lump sum of your money upfront. We understand you might be allotting the rest of your money to equally important matters such as the education of your kids or maybe you are paying for a house at the same time.

The main disadvantage of paying cash upfront for a car is that you will have to release a huge lump sum of your money upfront

2. The cost of an installment is acceptable

If you are low key then there are tons of cars in the Philippines with low monthly payment, for only around P10,000 to P12,000 pesos and the interest rate is low as well. With low costs, you can then instantly own a car that otherwise you would be bending over to so you can afford it.

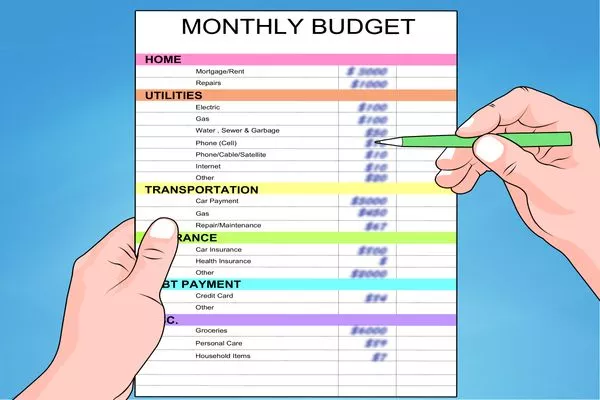

Your monthly car payment, along with other monthly household bills, should be budgeted wisely

If you have the money, then pay for the car in cash. If you don’t or if you have a more productive use for the rest of your money then choose to pay via installment. We hope our article can give you helpful tips and advice on your car buying. It’s your car, your decision. Who are we to judge?

Recent posts

- How to get a car history check before buying a car Jun 09, 2021

- Understanding taxes and fees when buying a car in the Philippines Nov 30, 2022

- Important Facts About Buying a Car Online in the Philippines to Avoid Being Scammed Apr 20, 2019

- 9 Questions To Ask Yourself Before Buying A Car In The Philippines Feb 14, 2019

- 10 things to consider before buying a car in the Philippines Aug 04, 2020