In the money lending business, the term “encumbered” refers to an object or property that was acquired via a loan, with the said loan still active and has not yet repaid. It could also mean the other way around, wherein the object was put up as collateral for a loan. This term commonly applies to objects with a hefty acquisition price like properties and automobiles. For the latter, however, it is referred to as a “chattel mortgage.”

No, not this type of encumbered...

What is an encumbered car?

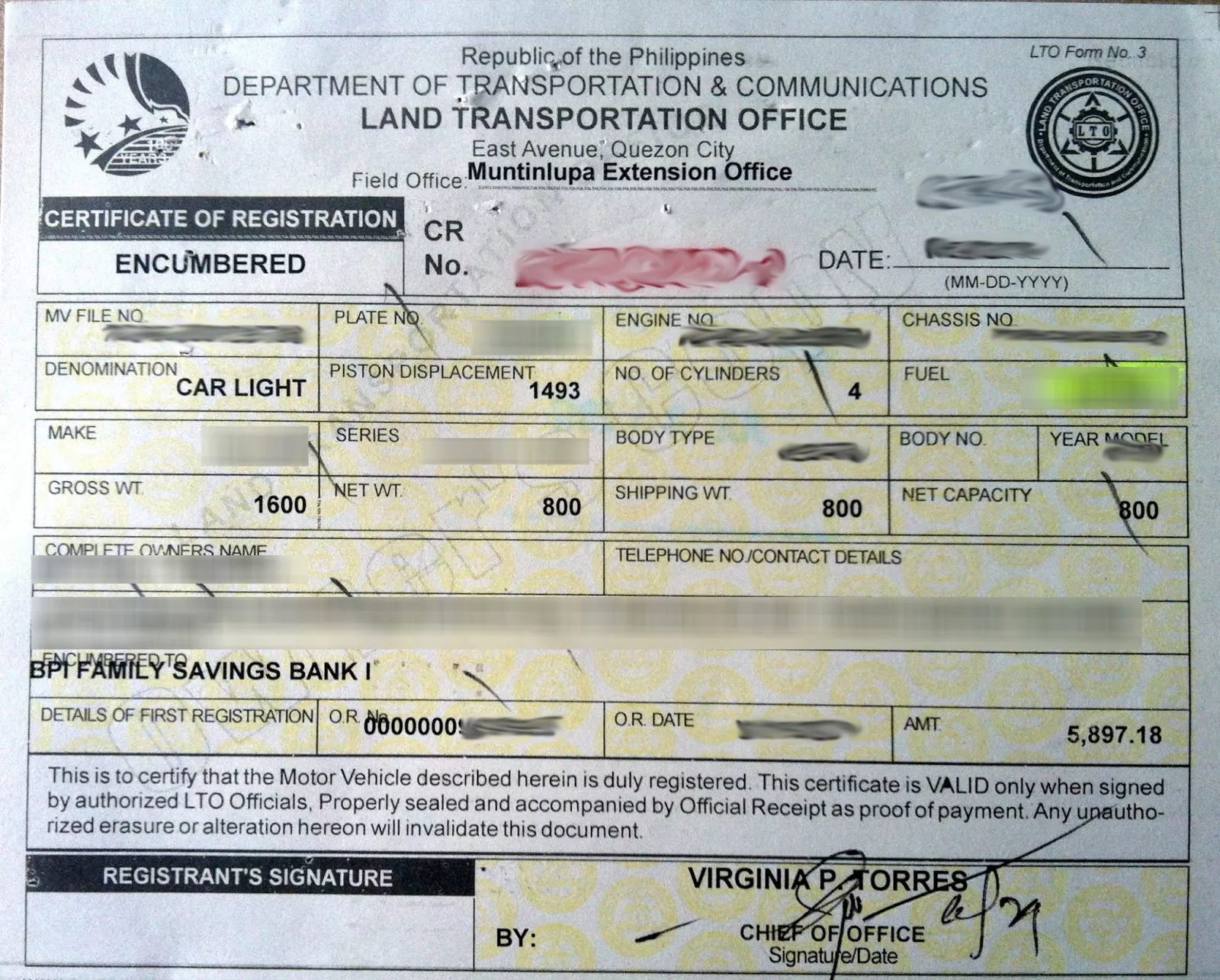

Obviously, cars usually come with a hefty acquisition cost. As such, one of the ways to purchase a car in the Philippines is to apply for a loan through a bank or a lending company. When a car is purchased through a car loan, it comes with a “Certificate of Registration Encumbered” (CRE) instead of the normal Certificate of Registration (CR).

The CRE means that the purchased car is technically the property of the bank or the lending company that provided the loan. Transfer of ownership can only be processed once the approved car loan payment is paid in full.

Encumbered car check: How to know if a car is encumbered?

To check whether a specific car is encumbered, simply look at the Certificate of Registration. If the part that states as “encumbered to” is filled up with the name of a financial institution, then it means that this particular vehicle is subject to a chattel mortgage.

Take note of the upper left and the "encumbered to" section

To put it in simple terms, the lender of the funds you used to acquire the vehicle will remain as the legal owner of the said vehicle until you pay off the loan. After that, you’ll then have to do the legwork in order to officially remove the encumbered status of the car and fully transfer its ownership to you.

Are there risks in buying an encumbered car?

This is actually a common practice in the Philippines. It’s called an “assume balance” scheme or pasalo in local slang. As it says on the tin, a car buyer will take on the remaining mortgage of the car after paying a “cash-out” for the equity.

And boy, those "cash outs" can be hefty

However, the seller can’t just put his/her encumbered car up for sale. The seller needs to get a written statement from the bank (owner of the car) that gave the loan. Without it, you basically broke the loan contract you have signed with the bank.

As such, when shopping for used cars, the seller needs to be honest and transparent in regards to the actual state of the car. The seller should inform the buyer that the car is still subject to financing, and the loan has yet to be paid in full.

In case you’re wondering, it’s actually punishable by law to sell a mortgaged property regardless of whether it’s a house or car.

Imagine seeing this happen to your newly acquired used car

On the other side of the coin, there were documented cases where the bank repossessed an encumbered car after it was bought by a new owner. In one particular case, the original seller failed to pay monthly loan payments, and the car was about to get repossessed. So he/she sold the car to another person, who then got to experience the painful sight of getting his/her new second-hand car towed away.

The bottom line here is that the seller and the buyer need to be on the same page. The seller has to be transparent to the buyer.

How to remove the encumbered status indicated on a car’s CR?

1. The first step is of course to fully pay off your car loan.

2. Check your car’s registration. Check if it’s up to date, and accurate. Also, make sure that there are no pending penalties.

3. Maintain frequent contact with the lending company or bank that provided the loan. If there are discrepancies in any of the related documents, do not hesitate to check that with them.

4. These documents include:

- The chattel mortgage form

- The original loan contract and one copy

- Two valid government issued ID (ex: Passport, driver’s license, Voter’s ID, Tax identification number ID, etc.)

5. With the aforementioned documents, you can now visit the financial institution that financed your car loan. There, you will need to obtain two copies of the “release of chattel mortgage.” You will also need to get the original registered promissory note with chattel mortgage, the car’s original certificate of registration, and official receipt. Do note that before releasing these documents, you may have to pay Php 300 to Php 500 because these papers need to be notarized.

As with any transaction with the LTO, it pays to go early

6. To continue, you’ll then need to visit the Registry of Deeds. Their branches are relatively easy to find, and it’s likely that each city will have a branch. Once there, fill out a form then submit it together with the release of a chattel mortgage, promissory note w/ chattel mortgage, and two valid government IDs.

7. Next, you need to go to the Land Transportation Office branch indicated on your car’s certificate of registration. Not just any LTO branch, but the exact one indicated on the CR.

Once there, you’ll need to present the same documents required for step six, the original CR of the vehicle, and the original OR with one photocopy. For this step, one should also prepare somewhere around Php 400.

After handing the required documents and the fees, the LTO will then print out a new CR minus the “encumbered” status on it. This new document proves that you are now the official owner of your vehicle.

Encumbered car: FAQs

1. Question: If the CR says LTO Quezon City, can I process the removal of the encumbered status in any other LTO branch?

Answer: No, you should go to the exact LTO branch indicated on the car’s CR.

2. Question: What does a “secured car loan” mean?

Answer: It means that if you miss one or two monthly amortization payments (depending on the financial institution), the lender has the right to “repossess” the property.

3. Question: Can you sell a car with an encumbrance?

Answer: You can. But, you’ll need to acquire the consent of the financial institution in written form.

4. Question: About how much will it cost to remove my car’s encumbered status?

Answer: Excluding the actual car loan, it will cost you somewhere around Php 1,000. You’ll have to consider making multiple copies of many documents too.

5. Questions: Can I process the removal of the “encumbered” status before completely paying off the car loan?

Answer: No, you’ll have to finish paying off the car loan first.

Recent posts

- BPI family savings bank new car loan Oct 07, 2020

- 8 Things to Consider to Get a Car Loan in the Philippines Oct 12, 2018

- Ultimate guide for Filipinos on how to deal with car loan defaults Oct 14, 2021

- Car loan Philippines: Which car financing option is right for you? (Part 2) Jan 18, 2018

- Car loan Philippines: Which car financing option is right for you? (Part 1) Jan 05, 2018