As car owners, we want to make sure that our vehicle is protected and covered by the best and trusted car insurance companies. While many car owners view comprehensive insurance as an added expense that can be done away with, it actually spares us from the cost of repairs and replacements if untoward incidents result in car damage. If you’re in search for the best car insurance Philippines, we are here to help.

We gathered some of the best car insurance policy as well as give some brief car insurance in the philippines reviews so that you can shop for to protect your cars.

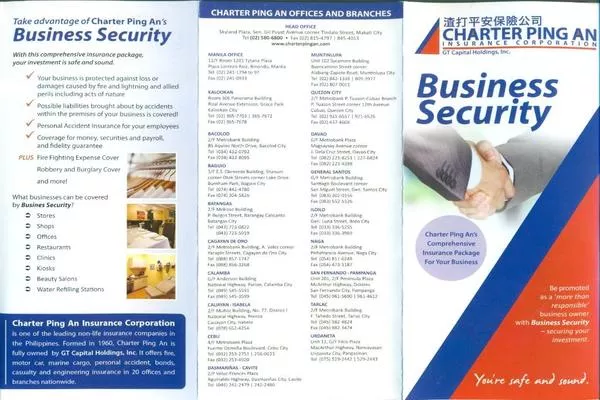

1. Best car insurance in the Philippines: Charter Ping An Insurance Corporation

Charter Ping An is a subsidiary of AXA Life insurance Corporation in the Philippines. This company offers non-life insurance services that include motor car, fire, marine, personal accident, casualty, bonds and even engineering insurance products. The following are some of the coverage and services they provide:

- Acts of nature

- Compulsory Third-Party Liability or most popularly known as CTPL

- Unnamed Passenger Personal accident or UPPA

- Excess bodily injury

- Overturning and malicious damage

- Property damage

- Theft

- Fire and explosion

- Accidental collision

Charter Ping An is a subsidiary of AXA Life insurance Corporation in the Philippines

Note that some of these are available as options only. The premiums on a Charter Ping An car insurance policy start at Php 15,600+ per year.

2. Best car insurance in Philippines: Malayan Insurance Company, Inc.

Malayan was founded in 1930 in the city of Manila and was formerly known as the China Insurance and Surety Company. It is currently operating as a subsidiary of the Yuchengco Group of Companies.

The following are the insurance coverage and services they provide:

- Third-Party Liability Cover

- Own damage

- Loss of use cover

- Personal accident cover

- Acts of God Protection

- Standard automobile accessories protection

- Strikes, riots, and civil commotion coverage

Malayan Insurance Company Inc. was formerly known as the China Insurance and Surety Company

Comprehensive car insurance premiums with the Malayan Insurance Company, Inc. started at Php 23,000+ per year.

>>> Read more: 10 must-know things to consider before buying car insurance in the Philippines.

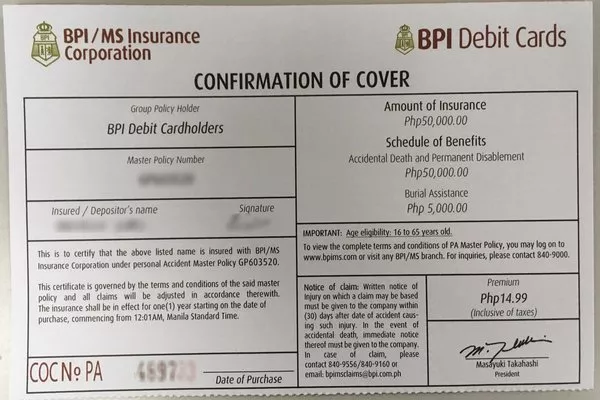

3. Best car insurance Philippines: BPI/MS Insurance Company

The BPI/MS Insurance Corporation is a joint venture between the Bank of the Philippine Islands and Mitsui Sumitomo Insurance, one of Japan’s biggest non-life insurance companies. BPI/MS specializes in underwriting for health and accident insurance. The following are some of the services they provide:

- Voluntary Third-Party Liability-Bodily Injury or VTPL-BI

- Compulsory Third-Party Liability or most popularly known as CTPL

- Theft

- Accidental collision

- Free Express Roadside Assistance

- Fire, lightning, explosion, self-ignition and malicious damage

BPI/MS Insurance Corporation is a joint venture between the Bank of Philippine Islands and Mitsui Sumitomo Insurance

Note that some of the above services are available as options only.

4. Best car insurance Philippines: FPG Insurance Co., Inc. (Federal Phoenix)

Founded in 1958, this company operates as a subsidiary of the Zuellig Group. Some of the insurance services they provide are the following:

- Theft

- Own damage

- Voluntary Third-Party Liability-Bodily Injury or VTPL-BI

- Compulsory Third-Party Liability or most popularly known as CTPL

- Accidental death and disablement benefits for both the passengers and driver

- Acts of Nature

- Medical expenses of Actual in/out-patient which is a result of an accident

- Burial expenses coverage

- Additional protection for surgical treatment as a result of a covered accident

FPG Insurance was founded in the year 1958 and operates as a subsidiary of Zuellig Group

The cost of car insurance premiums with the FPG Insurance Co., Inc. starts at Php 15,000+ per year.

>>> Also check: 10 add-ons must-have for your car insurance policy.

5. Best car insurance Philippines: Pioneer Insurance & Surety Corporation

Pioneer was established in 1954. In terms of written gross premiums and total assets, this insurance provider was one of the top insurance companies earlier in the decade.

Some of the insurance services they provide are the following:

- Theft

- Own damage

- Compulsory Third-Party Liability or most popularly known as CTPL

- Excess Third-Party Liability – Death/Bodily injury

- Excess Third-Party Liability – Property Damage

- Passenger’s Accident insurance

- Acts of Nature Cover or often called AON

- Personal Effects

- Loss of Use

Pioneer insurance company was established in the year 1954

Note that some of the given is available as an option only.

6. Best car insurance Philippines: Commonwealth Insurance Company (CIC)

This car insurance company in the Philippines began in 1953 under Don Andres Soriano, who also expanded the original San Miguel Brewery into the present-day San Miguel Corporation. The following are some of the coverage and services they provide:

- Acts of Nature

- Carnapping

- Bodily injury

- Own Damage

- Property Damage

- Personal Accident

- Third-Party Liability

Commonwealth Insurance Company (CIC) began in 1953 under Don Andres Soriano

Premium car insurance policies of the Commonwealth Insurance Company start at Php 16,300+ per year.

>>> Must read: What kind of car insurance in the Philippines fit you the most?

7. Best cheap car insurance Philippines: Standard Insurance Company Inc.

Operating as a non-life insurance company, Standard Insurance Company Inc. offers property, cellphone, motor car, marine, general liability, and accident insurance services, covering the following:

- Theft

- Loss of Use Cover

- Coverage for Acts of Nature

- Own damage

- Third-party property Damage or TPPD

- Excess Bodily Injury or EBI

- Voluntary Third-Party Liability or VTPL

- Compulsory Third-Party Liability or CTPL

- Add-on coverage such as Free Personal Accident insurance for the named insured, Free PA Rider or Personal Accident insurance Rider, and/or Roadside Assistance Program or RAP

The cost of car insurance premiums under Standard Insurance Company Inc. starts at Php 17,800+ per year.

>>> Check out: Which is the best car insurance company in the Philippines?

Applying for car insurance in the Philippines

If you don't have any idea on how to apply for auto insurance, the first thing you need to do is to research the best car insurance in the Philippines in terms of your budget and the protection coverage you require.

Once you have an insurance company in mind, you can ask their policyholders regarding their experiences with the company, such as claims processing and payment of premiums. If you finally decide on getting an insurance policy for your car, the insurer typically has four main requirements:

- Car’s OR/ original receipt

- Driver’s License

- Car’s CR/ certificate of registration

- An additional ID issued by the government such as Philippine passport, Philhealth ID, TIN Card, Postal ID, Voter’s ID, PRC ID, and OFW ID.

When choosing the best car insurance Philippines, make sure the coverage and services they offer and provide match your needs and wants. You can also talk to their agent about discounts and other special services they provide. For more useful articles like this, make sure to check out Philkotse.com.

Recent posts

- Choose yourself with the better cars for low insurance premiums Oct 28, 2022

- What is accidental death insurance and what does it cover? Aug 16, 2022

- 5 common car insurance scams and how to avoid them Aug 16, 2022

- What insurance covers the damage of natural disasters and how does it work? Aug 09, 2022

- Car smart: Filing a Compulsory Third Party Liability (CTPL) insurance claim Mar 12, 2019