Buying a second hand or used cars is now the best way to do car shopping. It is smart and practical without putting a huge dent in the budget. Sure, the price and all its economic advantages may cause you to close the deal sooner than later but it will surely be smarter to also do a little background check of a prospective purchaser.

It is smart and practical without putting a huge dent in the budget

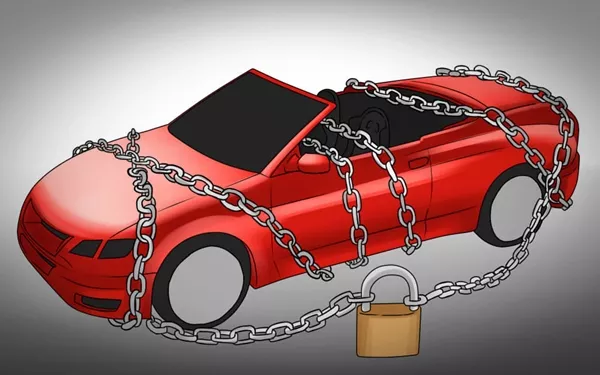

What one needs to be nit-picky about it is if your potential car has an outstanding lien. If you purchase a car without you knowing that it has a lien that you are up for a big surprise especially for your bank account. What’s worse is that there is the possibility of your car being repossessed too. Let's Philkotse.com guide you to know more about car lien and what you need to know about it.

1. Car lien

A car lien in simplest terms is somewhat collateral for lenders just in case that the car buyer default on the monthly or agreed-upon payments. Liens are automatically created when an auto loan is used to buy the car.

It acts as the lender’s legal right to take the car until the whole loan is paid off. If the buyer defaults or fails to make the payments for the loan, the lender can repossess the car. The lender can be a third-party entity like a bank or even a private individual. The deal with car liens is pretty easy and smooth so long as transparency and a proper handover are done.

A car lien in simplest terms is somewhat collateral for lenders

>>> You might concern: 8 Things to Consider to Get a Car Loan in the Philippines.

2. The difference of lien from loan

The car lien pertains to the lender’s rights against the car that it is being financed while a car loan is an actual cash being lent to the borrower. A potential car buyer can apply and be granted a loan for a car but it won’t be automatic that it is protected by a lien.

A specific example would be is when the car buyer already has an existing line of credit with the moneylender. When the buyer uses his credit line to pay off the vehicle then the lender can actually waive the lien on the car.

A potential car buyer can apply and be granted a loan for a car but it won’t be automatic that it is protected by a lien

3. Why do you need to check for a possible lien?

To be direct about it, if you buy a car with an existing lien against it, you cover and become responsible for its unpaid debt. The lenders don’t actually care who the current owner is so long as the payments are made.

Regardless if you are the original owner of the car or the second or third, it doesn’t matter. You will be responsible for settling the lien payments if you have become the current listed owner. Failure to do so can cause the car to be repossessed.

If you buy a car with an existing lien against it, you cover and become responsible for its unpaid debt

>>> Check out:

- Car loan Philippines: Which car financing option is right for you? (Part 1).

- Car loan Philippines: Which car financing option is right for you? (Part 2).

4. Checking for any possible liens

Having a clear and honest conversation with your dealer is always the best approach so you can determine if there is any existing lien of your potential next car.

However, there are instances when sellers are also not truthful when it comes to this fact. In cases where there are some trust issues involved, you can have your own methods to find out if there are any liens associated with your future car.

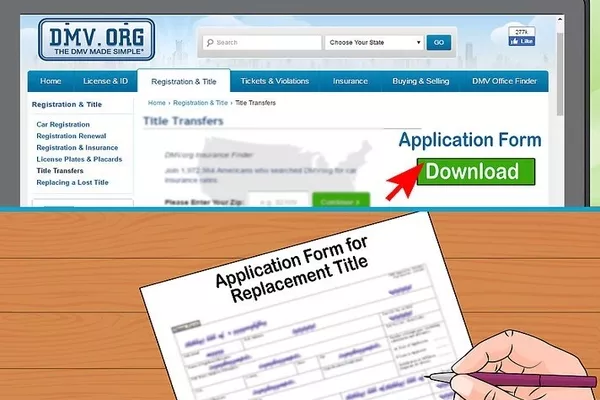

Check the DMV site

The smartest first step in checking a car’s history is by checking the DMV website. It boasts a comprehensive website that can help you have a better understanding of the car’s ownership and history.

In case your research yields that the seller still has some unsettled debts on the car. Unfortunately, though, not all liens are listed on the DMV website.

Cars are considered as properties and as such if the seller has back taxes against the state government or the IRS then there is a high probability that there is an existing lien too. If this is the case, then it would be best to just walk away from this car and all its potential additional baggage.

The smartest first step in checking a car’s history is by checking the DMV website

Go through the paperwork

A critical and a sharp eye can do wonders so it is recommended to go through the car’s documents especially the Certificate of Registration (CR) and the title. While there might be some slight differences with the information, it should still contain the pieces of information that can put the puzzle pieces of the car’s history and previous owners.

The car’s documents can also be a good source for previous and current liens. For the CR, if the car has an existing lien against it then usually the text “encumbered” is visibly stated.

A critical and a sharp eye can do wonders so it is recommended to go through the car’s documents

The more papers, the better

This is significantly related to the initial paperwork. If the title shows that there is a lien, then get with the seller and get an update of the current state. If the seller declares it paid then request for a copy of the lien release documentation that is commonly referred to as the cancellation of the chattel mortgage.

This is a legal document declaring that the lien is indeed close and should pose no issues in the future. In case there is still an existing lien, then ensure that the complete documentation is properly transitioned to you.

>>> Revelant article: How to get approved for a car loan in the Philippines?

Drop by the LTO

The LTO is more than just a department for licenses but you can also request for a Duplicate Certificate of Registration for Private Vehicles. This particular report can come in handy as it can provide you with lien information. As an added bonus, you can also be made aware of any previous accidents or even crimes that your future can have been involved with.

5. Resolve the lien

It would be best to actually get all the information and deal with the lien before finally closing the purchase of the car. The seller should be able to provide you with a copy of the official lien release and afterward, you can present that to the LTO to confirm the document.

The seller should be able to provide you with a copy of the official lien release

The agency will then proceed in updating their records and eventually cancel the nuisance on the next CR that will be released. Once that’s done, it should cause you no worries in the future and you have clear and sole ownership of the car.

Overall, purchasing a car with an existing or a previous lien should not very much impact the purchase of a used car. So long as open communication and transparency are practiced between the seller and the buyer then all is well.

Recent posts

- Buying tips: What is the best budget for getting used cars? Oct 20, 2020

- For car buyers - Top 5 most underrated used cars in the Philippines Oct 28, 2022

- Used car buying tips: How much should I pay for a used car? Aug 09, 2022

- How to get an alternative car loan if denied in the Philippines Aug 04, 2020

- Ultimate guide for Filipinos on how to deal with car loan defaults Oct 14, 2021