The Philippines is one of the countries that has been greatly affected by the COVID-19 virus. As of this writing, the country has 530,000 cases and more than 10,000 deaths. Along with those numbers, several businesses have closed their doors that resulted in a spike in the country's unemployment rate.

The local automotive industry suffered a huge blow in 2020 due to the pandemic. With limited economic activity, strict quarantine guidelines,

and low demand for cars, the Philippines automotive market faced a drastic slump in sales.

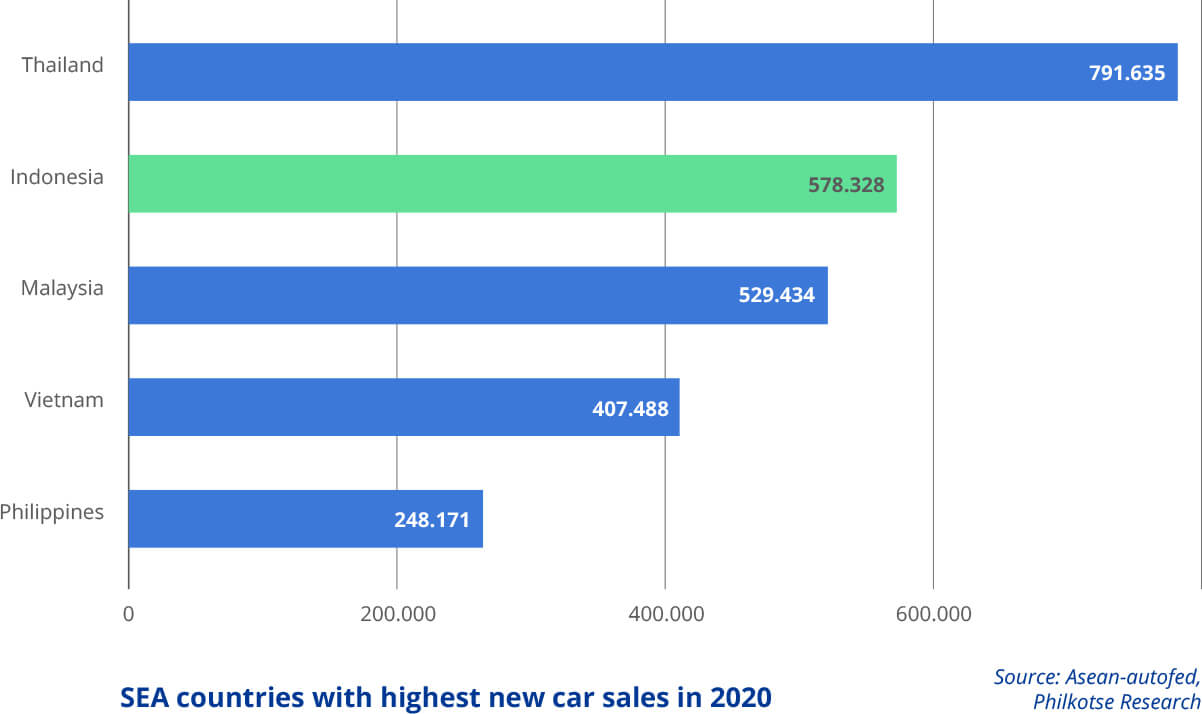

The data shows that the local auto market finished 2020 with 248,171 unit sales, dwarfed by

the number of units sold in 2019 which is 416,627. This translates to a year-over-year decrease of 40-percent.

To put things in perspective, automotive sales in the Philippines last April 2020 went down by almost 99

percent with only 133 units sold. In May 2020, local auto sales went up

a bit but it only registered 4,788 units sold, which is 85 percent lower than the same period in 2019.

Automotive sales in the Philippines started to regain momentum when the majority of the country was placed under General Community Quarantine (GCQ). In June 2020, local auto sales yielded 15,578 units, which is a 69 percent increase. Then, the local automotive industry continued to show positive momentum in July 2020 with 20,542 unit sales, but a slight dip was registered in August 2020 with 17,905 units sold.

ADespite the downward trend in car sales, the Philippines market started to pick itself up in the fourth quarter of 2020 as it posted more than 25,000 unit sales in October 2020.

As a result, Vietnam managed to overtake the Philippines in terms of vehicle sales in 2020.

Vietnam's car sales accounted for 407,488 units sold, which is a far cry from the Philippines' 248,171 units.

The top-selling Southeast Asian country is Thailand with total unit sales of more than 791,000. It's followed by Indonesia with 578,000, and Malaysia with 529,000 units sold.

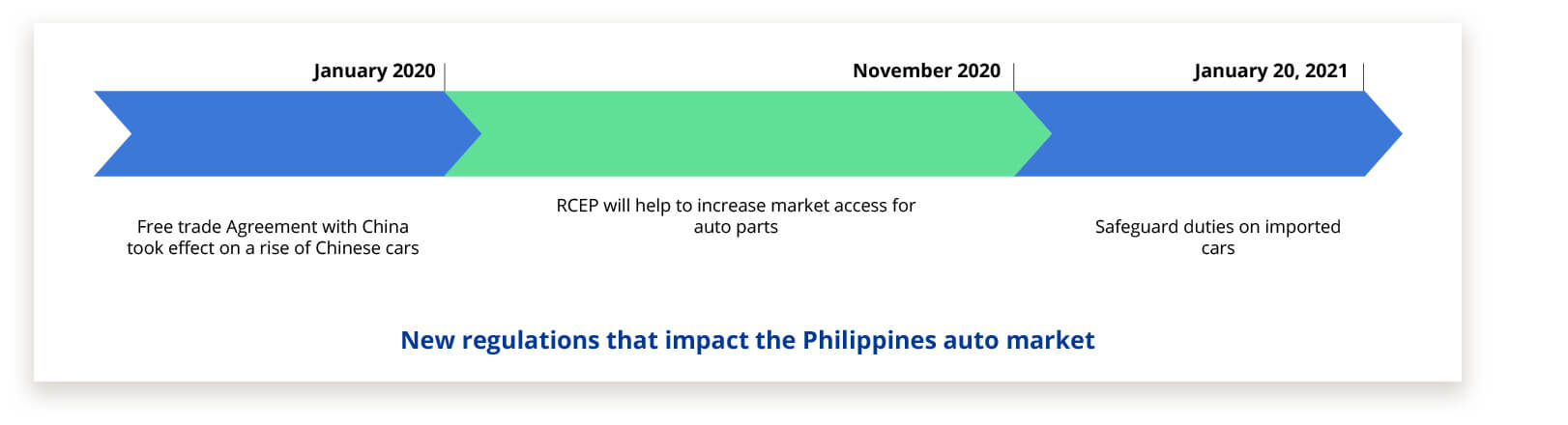

Before the pandemic hit, the Philippines' free trade agreement with China further saw the resurgence of Chinese car brands in the country such as Geely, Chery, MG, Maxus, among others.

The free trade agreement with China imposes lower tariffs or tax on imported cars sourced from the Land of the Red Dragon.

As a result, Chinese cars are sold at a more attractive price as compared to locally-made vehicles and other imported cars from Japan, South Korea, and other ASEAN countries.

On the other hand, the trade agreement on Regional Comprehensive Economic Partnership (RCEP) was signed in November 2020.

RCEP is said to help reduce the prices and give better access to vehicle components and parts.

However, most of the car brands in the Philippines were surprised by the newly imposed safeguard duties that were implemented last January 2021.

The Department of Trade and Industry (DTI) announced the imposition of safeguard duties on imported cars.

The DTI is imposing a provisional safeguard duty or tariff in the form of a cash bond amounting to Php 70,000 per unit for imported passenger cars and

Php 110,000 per unit for imported light commercial vehicles. The safeguard duties were seen as necessary to protect the local or domestic motor vehicle

manufacturing industry. But, the added import tax would force car brands in the Philippines to increase prices, which could affect the overall recovery of the industry.

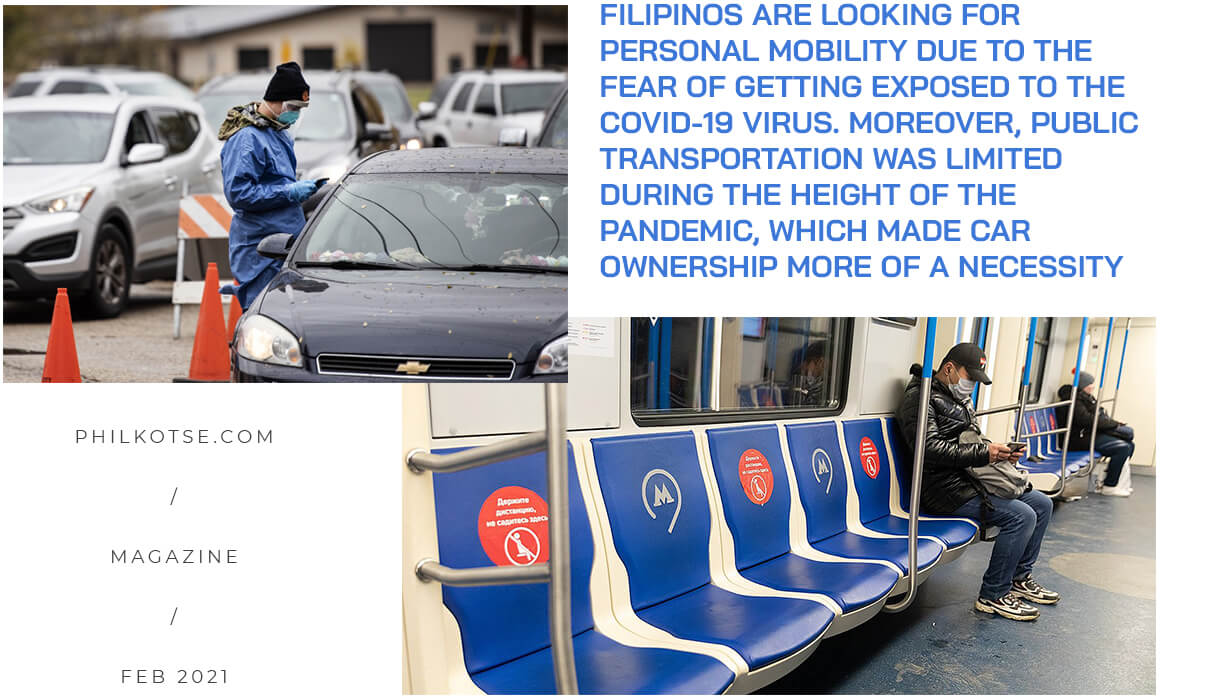

Interestingly, car sales in the Philippines last 2020 were driven by first-time car buyers.

The data showed that 79-percent of car buyers in the Philippines last year were first-time buyers.

One of the reasons that can be attributed to this trend is that Filipinos are looking for personal mobility due to the fear of getting exposed

to the COVID-19 virus. Moreover, public transportation was limited during the height of the pandemic, which made car ownership more of a necessity.

The data showed that 81-percent of first-time car buyers applied for a car loan to be able to

purchase a vehicle. On the other hand, first-time car buyers have lesser tendencies to compare prices across dealerships before making the actual car purchase.

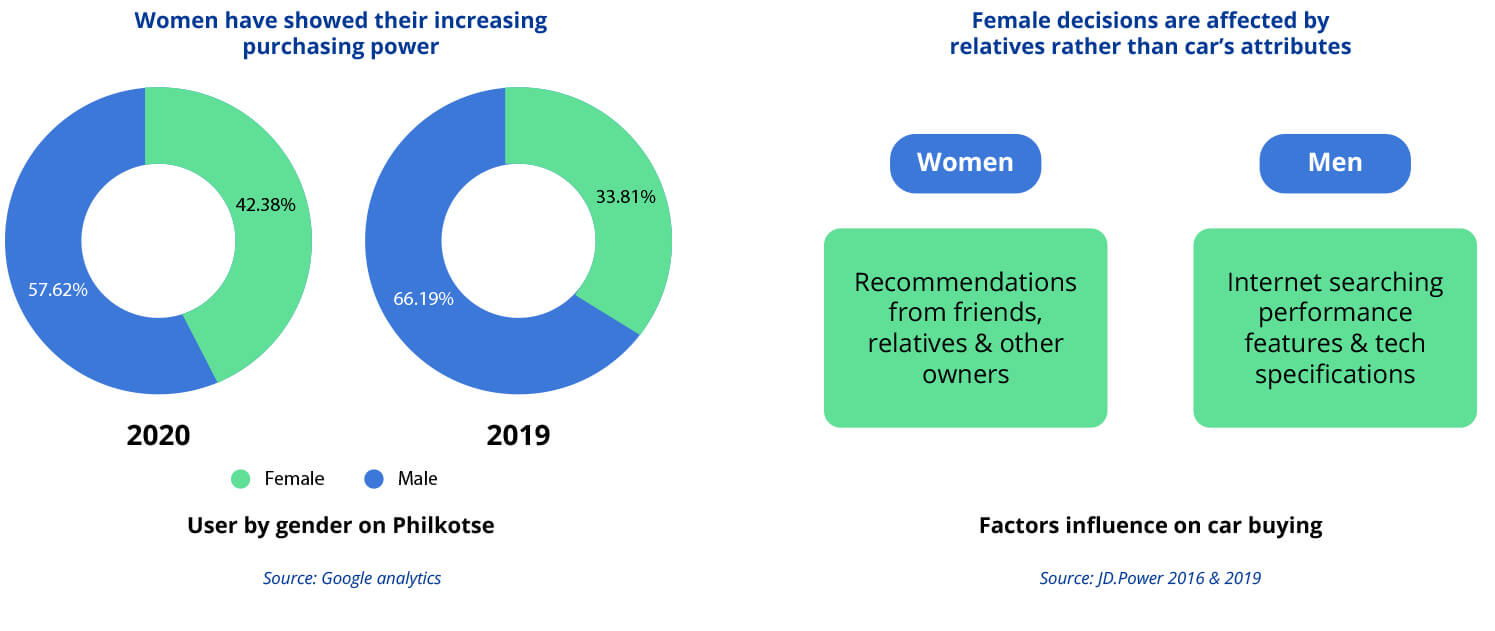

Philkotse's data also saw that the interest of women increased when it comes to cars. In addition to that, the data suggests that women car buyers rely on their relatives' advice and suggestions when shopping for a vehicle.

The past year has been rough and challenging for the Philippines automotive market.

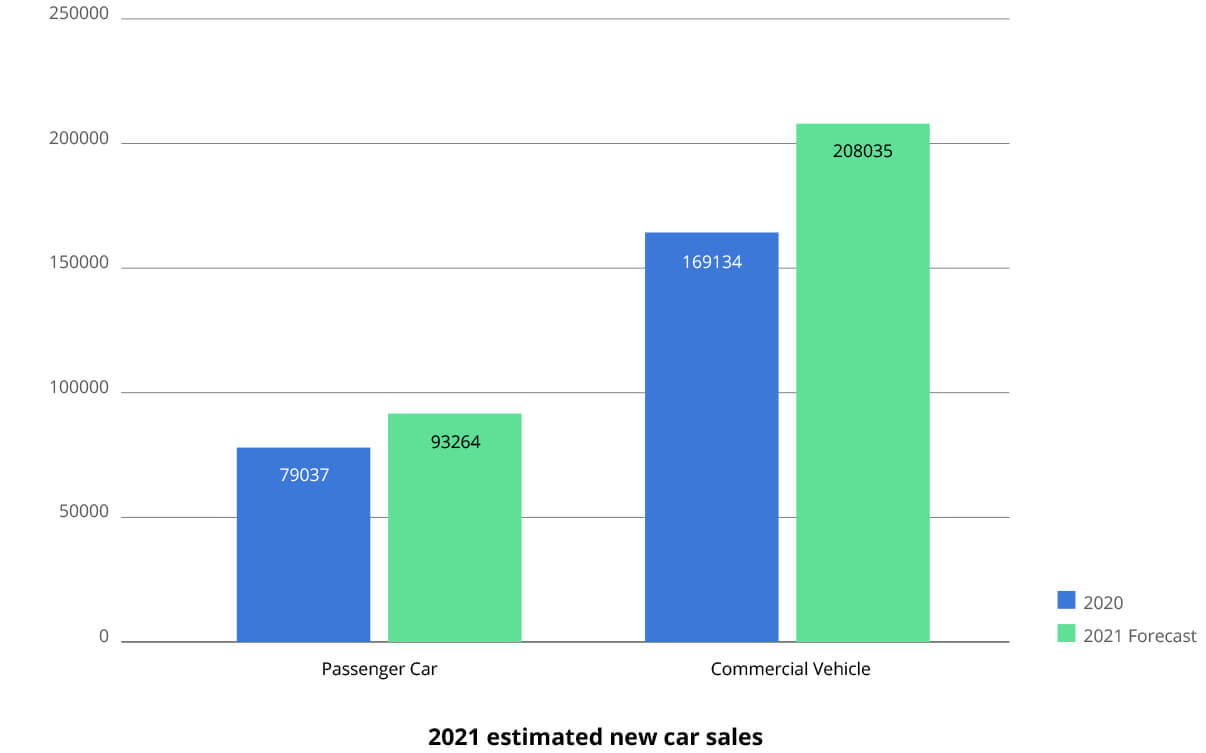

However, a study by Fitch Solution states that the local auto market could rise by as much as 21.5-percent this year as compared to 2020.

One of the contributing factors for the said increase is the increasing demand for commercial vehicles due to the various infrastructure projects in the country.

With this, commercial vehicle sales is projected to hit more than 208,000 units this year while passenger car sales is at 93,000.

With that, the Philippines automotive market is looking to bounceback this 2021. Despite the drastic losses in 2020, the industry is ready to move forward.